Step-by-Step Guide: Utilizing a Home Loan Calculator to Plan Your Mortgage Budget

Step-by-Step Guide: Utilizing a Home Loan Calculator to Plan Your Mortgage Budget

Blog Article

Smart Loan Calculator Service: Simplifying Your Economic Estimations

Visualize a device that not only simplifies complex funding calculations but additionally provides real-time insights into your monetary dedications. The smart funding calculator option is designed to improve your financial estimations, offering a seamless method to assess and prepare your loans.

Benefits of Smart Car Loan Calculator

When examining monetary options, the benefits of making use of a smart car loan calculator end up being apparent in promoting notified decision-making. By inputting variables such as financing quantity, passion price, and term length, people can evaluate different situations to choose the most cost-efficient option tailored to their monetary situation.

Additionally, smart funding calculators use transparency by breaking down the total expense of loaning, including interest settlements and any kind of extra fees. This transparency equips individuals to comprehend the economic ramifications of securing a funding, enabling them to make sound economic choices. Furthermore, these devices can conserve time by giving immediate computations, getting rid of the demand for hand-operated calculations or complicated spreadsheets.

Attributes of the Device

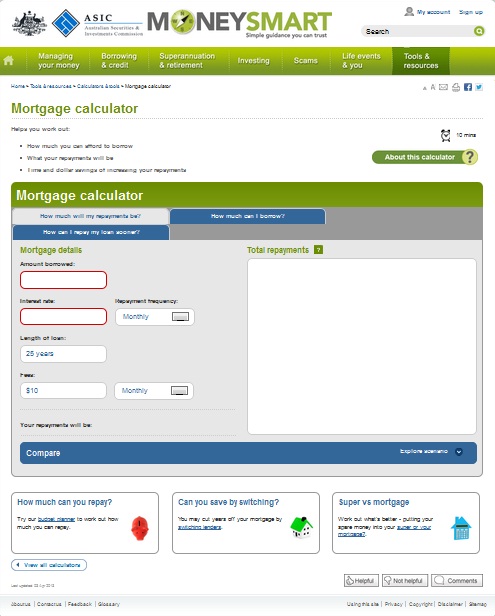

The device incorporates an user-friendly user interface made to improve the procedure of inputting and examining funding data successfully. Customers can conveniently input variables such as finance quantity, rate of interest, and funding term, allowing for fast computations of month-to-month settlements and overall rate of interest over the funding term. The tool likewise offers the adaptability to adjust these variables to see exactly how adjustments impact the overall car loan terms, encouraging customers to make informed economic choices.

Additionally, the smart loan calculator offers a failure of each month-to-month settlement, revealing the part that goes in the direction of the major amount and the interest. This function helps individuals visualize how their settlements contribute to paying off the funding gradually. Users can generate comprehensive amortization schedules, which outline the repayment routine and interest paid each month, aiding in long-lasting monetary planning.

How to Make Use Of the Calculator

In browsing the finance calculator successfully, individuals can quickly take advantage of the straightforward interface to input crucial variables and generate useful economic understandings. To begin using the calculator, customers ought to initially input the finance amount they are considering. This is generally the overall amount of money obtained from a lending institution. Next off, individuals need to enter the loan term, which refers to the period over which the lending will be settled. Following this, the passion rate need to be inputted, as this significantly influences the total cost of the loan. Users can also define the settlement regularity, whether it's regular monthly, quarterly, or each year, to straighten with their financial preparation. When all essential areas are completed, pressing the 'Calculate' button will promptly process the info and provide vital details such as the month-to-month payment quantity, complete interest payable, and general financing price. By following these easy check out this site actions, users can effectively utilize the loan calculator to make informed economic choices.

Benefits of Automated Estimations

Automated computations simplify financial processes by quickly and properly calculating complicated figures. Hand-operated estimations are prone to errors, which can have significant implications for financial decisions.

In addition, automated calculations save time and increase effectiveness. Facility economic calculations that would usually take a substantial amount of time to complete by hand can be performed in a portion of the moment with automated devices. This enables economic professionals to concentrate on examining the outcomes and making notified decisions as opposed to spending hours on computation.

This consistency is important for contrasting various financial circumstances and making audio financial choices based on Get More Information precise information. home loan calculator. Overall, the advantages of automated calculations in streamlining economic procedures are indisputable, using increased precision, effectiveness, and consistency in intricate financial computations.

Enhancing Financial Planning

Enhancing monetary preparation entails leveraging innovative tools and techniques to optimize financial decision-making processes. By utilizing sophisticated monetary preparation software program and calculators, businesses and people can obtain much deeper understandings right into their monetary health and wellness, set practical objectives, and create actionable plans to achieve them. These devices can evaluate various financial circumstances, project future end results, and provide referrals for reliable wealth monitoring and threat reduction.

Moreover, boosting economic planning encompasses including automation and man-made knowledge right into the process. Automation can simplify regular economic jobs, such as budgeting, expense tracking, and financial investment tracking, liberating time for strategic decision-making and analysis. AI-powered tools can provide personalized monetary guidance, recognize trends, and recommend optimum investment opportunities based upon individual danger accounts and financial purposes.

In addition, collaboration with economic consultants and specialists can enhance financial preparation by offering valuable understandings, sector knowledge, and personalized methods tailored to specific financial goals and situations. By combining sophisticated devices, automation, AI, and expert recommendations, businesses and people can boost their economic planning capacities and make notified decisions to secure their monetary future.

Verdict

In final thought, the smart funding calculator remedy offers numerous advantages and features for improving financial estimations - home loan calculator. By using this tool, users can quickly determine car loan settlements, interest prices, and settlement schedules with precision and performance. The automated estimations provided by the calculator improve monetary planning and decision-making procedures, ultimately resulting in far better monetary management and educated selections

The smart loan calculator service is developed to improve your economic computations, providing a seamless method to analyze and intend your car loans. In general, the benefits of automated estimations in enhancing financial procedures are indisputable, using increased accuracy, efficiency, and consistency in complicated economic calculations.

By making use of innovative economic planning software and organizations, individuals and calculators can acquire much deeper understandings into their monetary health, established realistic objectives, and create actionable strategies to accomplish them. AI-powered tools can supply customized financial guidance, identify patterns, and recommend click to find out more ideal investment possibilities based on specific risk profiles and economic purposes.

Report this page